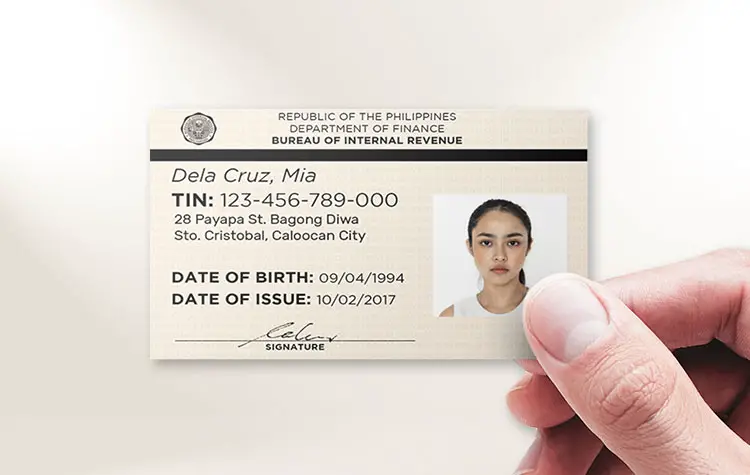

A Taxpayer Identification Number (TIN) ID card is an official document issued by the Bureau of Internal Revenue (BIR), containing the cardholder’s TIN, full name, residential address, date of birth, photograph, and signature.

The issuance of a TIN ID card is in accordance with the Tax Code of the country, which mandates that any individual legally obligated to file a tax return or other related documents must be assigned a TIN, which must then be included in the said documents for tax-related purposes.

Even if you are not currently employed or are still a student, possessing a TIN ID is essential because it is mandatory for nearly all government and private transactions. For example, you can utilize it to establish a bank account or to apply for licenses, permits, clearances, and various government-issued identification cards.

FEES

It’s important to note that a TIN ID card is provided at no cost and does not come with an expiration date.

REQUIREMENTS

- Fully filled out the BIR registration form

- Form No. 1901 is designed for use by self-employed individuals, those with mixed incomes, non-resident aliens involved in business activities, as well as estates and trusts.

- Form No. 1902 is intended for individuals whose income consists solely of compensation, including both local and foreign employees.

- Form No. 1904 is designated for individuals who are one-time taxpayers or those who are registering under Executive Order 98.

- Any one of the subsequent identification documents

- Passport

- Social Security System (SSS) card

- Government Service Insurance System (GSIS) card

- Unified Multi-Purpose Identification (UMID) card

- Land Transportation Office (LTO) Driver’s License

- Professional Regulatory Commission (PRC) ID

- Overseas Workers’ Welfare Administration (OWWA) E-Card

- Philippine National Police (PNP) Permit to Carry Firearms Outside Residence

- Airman License

- Philippine Postal ID

- Seafarer’s Record Book

- PSA birth certificate

- Community Tax Certificate (cedula)

- 1×1 picture

- Marriage contract (for married women)

PROCEDURE

Every taxpayer is allocated to a specific Revenue District Office (RDO), responsible for overseeing tax matters in the taxpayer’s residence or business area. Consequently, you can only obtain your TIN card from your assigned RDO.

As a general practice, you are required to personally handle the application process. Nevertheless, you have the option to appoint an authorized representative by executing a Special Power of Attorney to obtain a TIN card on your behalf.

To get the TIN ID, do the following:

- Visit the closest BIR branch to obtain a form (refer to the requirements).

- Present the form along with the required supporting documents to the Revenue District Office (RDO) located in your city or municipality of residence.

- The RDO staff will handle your application. Typically, if you submit your request before the 1:00 PM deadline, the RDO will issue the TIN card on the same day.

- In case the office experiences a shortage of ID paper or encounters technical issues, they may ask you to return within one to three business days.

- Visit the same RDO on the date scheduled by the personnel to collect your TIN ID card. Remember to affix your 1×1 picture and sign your TIN card upon receipt.

IMAGE GALLERY