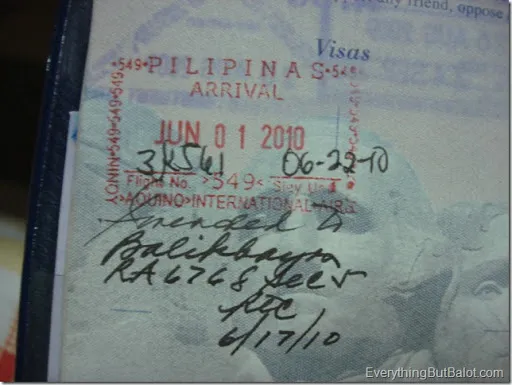

The Philippine Government initiated the Balikbayan Program under Republic Act 6768 (enhanced by Republic Act 9174) to entice and motivate overseas Filipinos to return and explore their homeland. This initiative acknowledges their significant role in bolstering the country’s economy by generating foreign exchange inflows and revenues.

Those classified as Balikbayans include:

- Filipino national who has resided outside the Philippines continuously for at least one (1) year

- Overseas Filipino Worker (OFW)

- An individual who was previously a Filipino citizen, naturalized in one of the specified countries, and returns to or visits the Philippines.

The Balikbayan Program also encompasses immediate family members (spouse and children) of the Balikbayan, who are citizens of the listed countries and traveling with the Balikbayan. It grants visa-free entry into the Philippines and a visa-free stay for up to one (1) year for former Filipino Balikbayans and/or their immediate family from those countries.

Former Filipino Balikbayans traveling to the Philippines are advised to declare to the Philippine Immigration Officer at the port of entry their intention to avail of this privilege and must present either their previous Philippine passport or a copy of their Philippine birth certificate as evidence of their former Philippine citizenship.

Accompanying family members of the Balikbayan should provide appropriate supporting documents:

- For the spouse: a copy of the marriage certificate

- For each child: a copy of the birth certificate

- For adopted children: a copy of the adoption papers

Note: Former Filipino citizens and their immediate family members who hold citizenship from countries not included in the list must acquire a visa before traveling to the Philippines.

In addition to visa-free entry, Philippine Law (R.A. 9174) grants benefits to Balikbayans:

- Tax-exempt purchases up to USD 1,500, or the equivalent in Philippine and other currencies, at Philippine Government-operated duty-free shops

- Exemption from Travel Tax provided that their stay in the Philippines is one year or less. If their stay exceeds one year, Travel tax will apply.

IMAGE GALLERY